How to Change a Nonprofit or Tax-Exempt Organization’s Name

There are multiple reasons why an organization may choose to change its name. Whether it’s from name confusion with other organizations, legal action, or the old name just isn’t cutting it anymore, nonprofit and tax-exempt organizations have options for changing their organization’s name.

The IRS has set certain procedures in place to facilitate organization name changes and these procedures vary depending on your organization’s type. Today’s ExpressTaxExempt blog is dedicated to discussing the name-changing process for tax-exempt and nonprofit organizations to help your organization effectively change its name.

Name Change Process:

1. Select a New Name: The first step in the name-changing process is to choose a name that represents your organization and mission, while avoiding the downfalls that impacted your organization’s previous name.

Confirm that the new name for your organization is still available for use and consider your state’s requirements for nonprofit names before any brainstorming sessions. Additionally, your organization will want to avoid any names that are too similar as ones that are already in use.

Certain words are banned from being used in nonprofit names including, “bank,” “reserve,” “United States,” and “federal.”

2. Review your Organization’s Bylaws: Most organizations have articles and bylaws outlining the desired renaming process. This process will need to be followed for any name change to occur. Holding a meeting regarding a potential name change or bringing the topic up in a meeting can be a productive way to inform board members of the desired change.

Holding a meeting allows key members of your organization a say in the process so that there are no surprises. It also allows your organization to weigh the pros and cons of the decision.

3. Notify the State: Before changing your organization’s name you will need to inform the state in which your organization is incorporated. To learn more about this step in the process, it is best to visit your state’s Secretary of State website.

4. Report your Organization’s New Name to the IRS: A tax-exempt organization must report name, address, and operational changes to the IRS. Most organizations can do this by filing their annual return, such as Form 990 or Form 990-EZ.

The IRS provides organizations with guidelines on how to report a change of name to the IRS, but most nonprofits will need to do so by filing a Form 990 Series Return.

An organization can report a name change on its annual Form 990 or Form 990-EZ. However, smaller organizations that file Form 990-N, or an organization that would like confirmation of the change in writing, will need to change name by contacting the IRS via letter or fax.

To contact the IRS regarding a name change call the Customer Account Services Department at (877) 829-5500 or send a fax to (855) 204-6184.

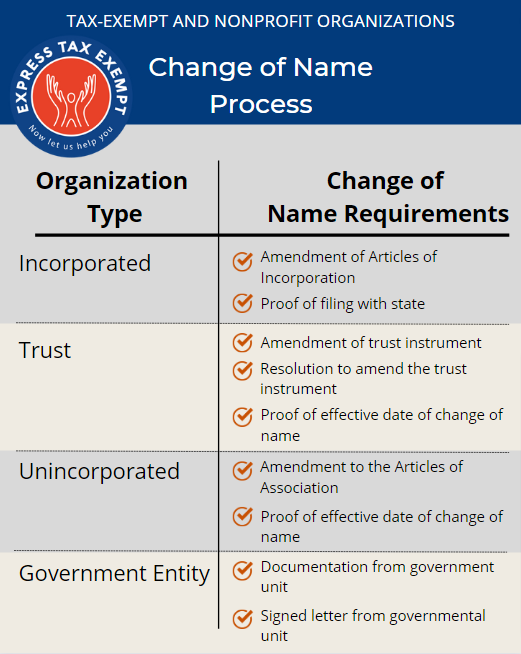

There are certain guidelines outlined by the IRS dependent on your Organization type:

For more information regarding change of name guidelines for nonprofit and tax-exempt organizations, click here.

ExpressTaxExempt

Once you have completed the change of name process, you will want to change your organization’s name within your ExpressTaxExempt account.

Follow these steps to change your organization’s name in your ExpressTaxExempt account:

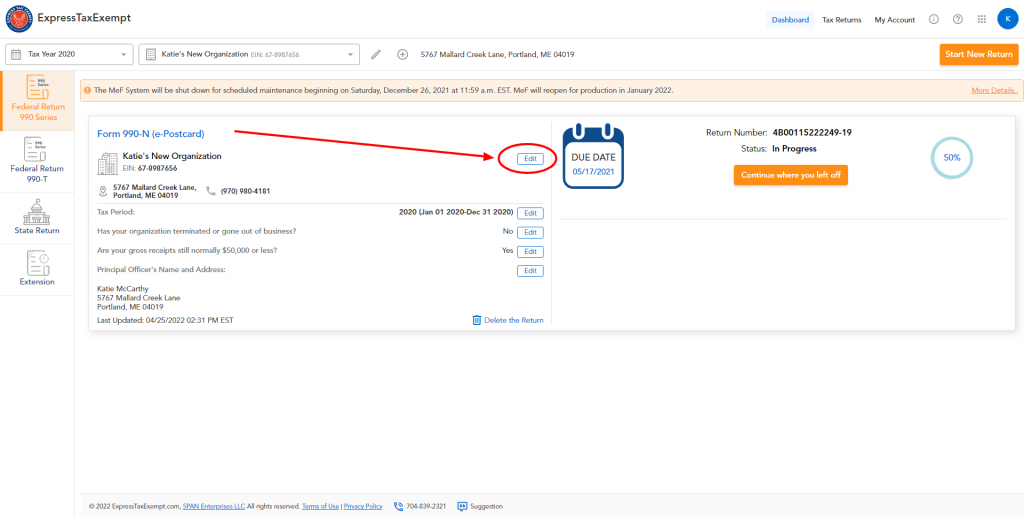

1. From your dashboard, click “Edit” next to your organization’s information:

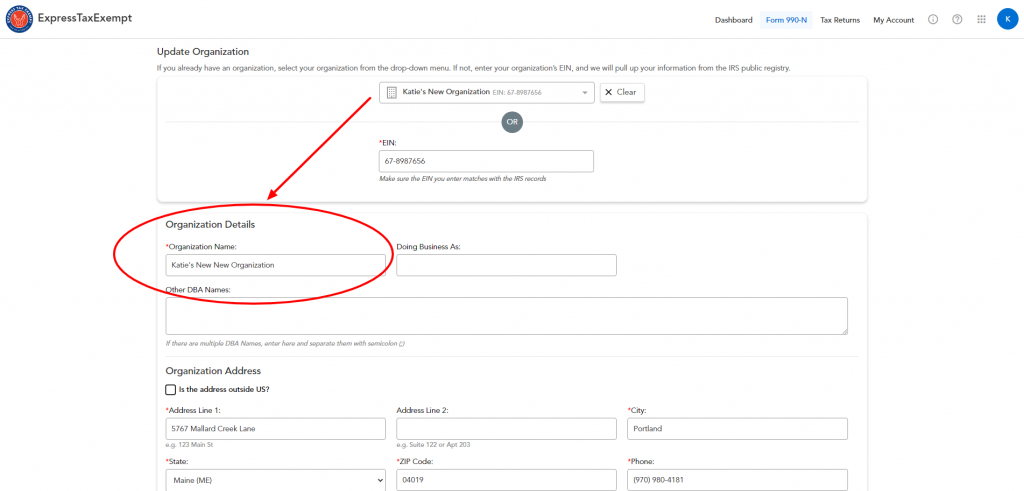

2. Change your organization’s name to the new name in the text box entitled “Organization Name”:

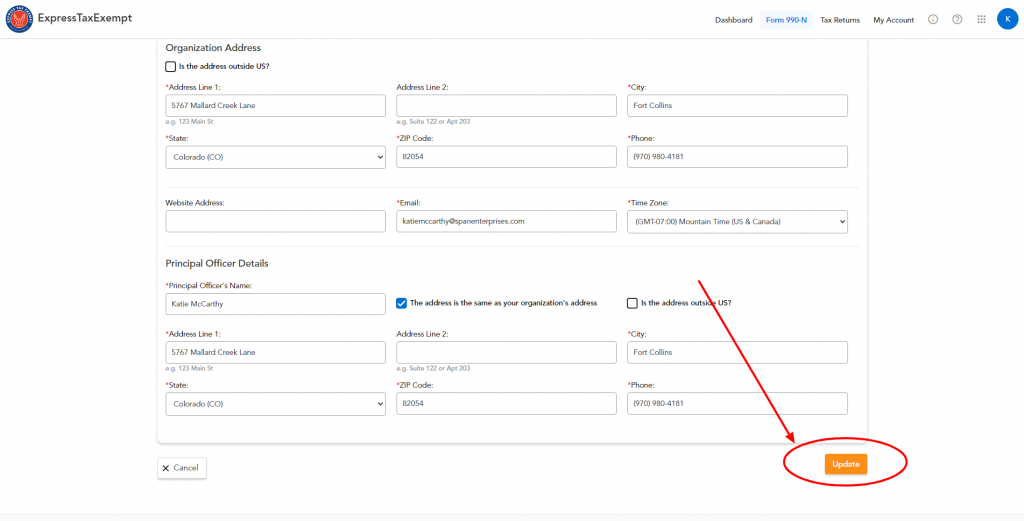

3. Click “Update” at the bottom of the page:

Once you have updated your organization’s information, your organization’s new name will appear on your ExpressTaxExempt dashboard.

ExpressTaxExempt is here all year long with helpful 990 series return e-filing tips, IRS updates, and nonprofit tax compliance. Come back every week for helpful blog articles dedicated to assisting nonprofit and tax-exempt organizations!

Does your organization operate on a calendar tax year? If so, you may have a return deadline of May 16, 2022. Click here for more information regarding the May 16 deadline.