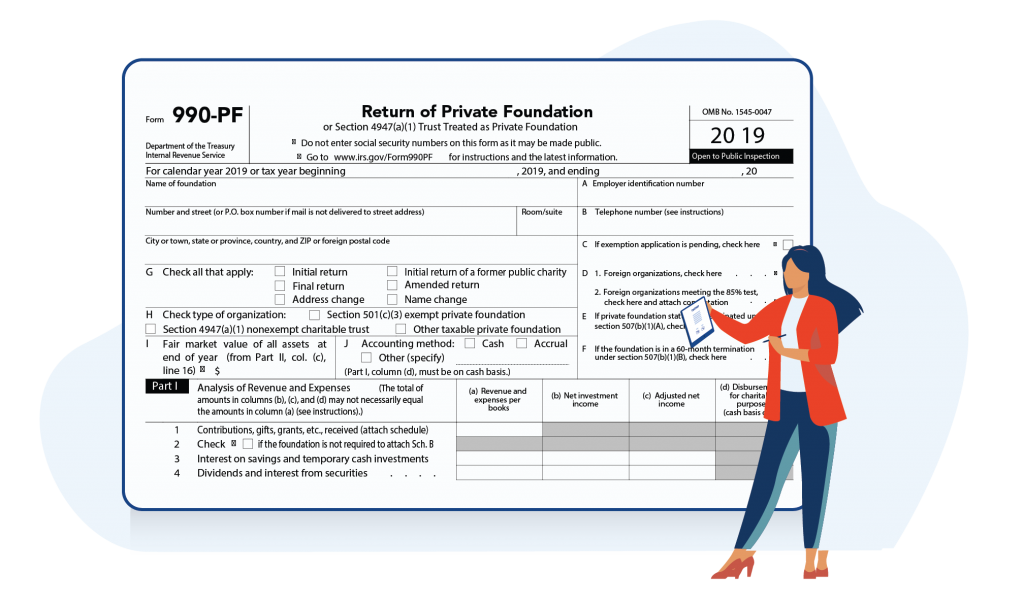

What is Form 990-PF?

Form 990-PF is mostly filed by private foundations, and Section 4947(a)(1) nonexempt charitable trust’s treated as private foundations.

Who needs to file Form 990-PF?

Things with the IRS are rarely as straightforward as they seem, and that means the private foundations required to report income and charitable information on Form 990-PF are:

- Exempt private foundations (section 6033(a), (b), and (c)),

- Taxable private foundations (section 6033(d)),

- Organizations with private foundation status whose applications for exempt status are pending and who haven’t yet applied for exempt status,

- Organizations that made an election under section 41(e)(6)(D)(iv),

- Private foundations making a section 507(b) termination, and

- Section 4947(a)(1) nonexempt charitable trusts treated as private foundations (section 6033(d)).

Reporting Additional Information on Schedule B

Much like the regular Form 990, Form 990-PF may require the filing of additional information to complete the return. IRS requires this additional information on Schedule B, Schedule of Contributors which is used to report information about any donations of money, securities, and other property worth at least $5,000.

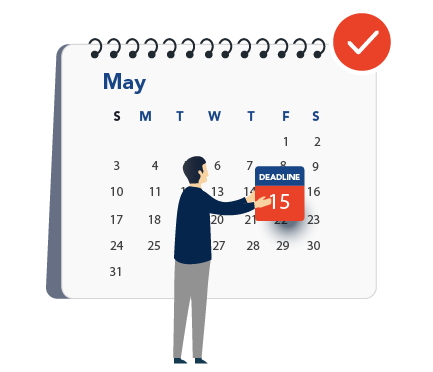

Deadline to file Form 990-PF

Like other 990 forms, Form 990-PF is also due by the 15th day of the fifth month after your tax year-end date.

For an organization operating in a calendar tax year, the due date is May 15th, which you may have noticed is quickly approaching.

Note: Due to the pandemic Corona effect, the IRS has extended all the deadlines that fall on April 15, 2020, to July 15, 2020. But, there is no update from the IRS about the change in May 15th deadline. Private foundations are still required to meet their annual 990 filing requirements.

Get Additional Time to file Form 990-PF

If you feel like you’ll need more time to get everything just right, apply for an extension using Form 8868, the extension form used to extend the 990-PF filing deadline to 6 months! File Form 8868 by your original deadline and you’ll receive an automatic 6-month extension of time to file your Form 990-PF.

ExpressTaxExempt, the trusted source for Form 990-PF Filing

If you are ready for the season, get started with ExpressTaxExempt to e-file your Form 990-PF directly with the IRS.

The step by step filing process from ExpressTaxExempt will help you to complete your Form without any hassle. All the details about contributors can be added using the bulk upload template that we provide, thus further simplify the reporting of Schedule B.

In case if you want to send your return to your board members for review, you can invite them to review the return before it gets transmitted with the IRS. Still, if you aren’t ready for the season, you can also apply for an extension using ExpressTaxExempt and get 6 months additional time to file your Form 990-PF.

More Questions?

If you have any other questions about Form 990-PF or e-filing with ExpressTaxExempt, don’t hesitate to give us a call! We’re always happy to help and we’re available by phone (704-839-2321), live chat, and email at [email protected]!