How to Complete Form 990-PF with ExpressTaxExempt

Before we jump into the 990-PF filing process with ExpressTaxExempt, let’s recap what this form is and who is required to file it with the IRS.

“IRS Form 990-PF is filed by certain private foundations to figure the tax based on investment income and report charitable distributions and activities.”

IRS Form 990-PF is comprised of 16 parts, and requires detailed information about your foundation’s activities, revenue, expenses, assets, and liabilities. Completing each part is, of course, a challenging task, and you may find yourself left with many questions. If this is the case, you can also check out our Form 990-PF instructions guide for a complete breakdown of Form 990-PF.

Now that we’ve given a brief overview of Form 990-PF, let’s break down the e-filing process with ExpressTaxExempt.

How to begin filing Form 990-PF with ExpressTaxExempt:

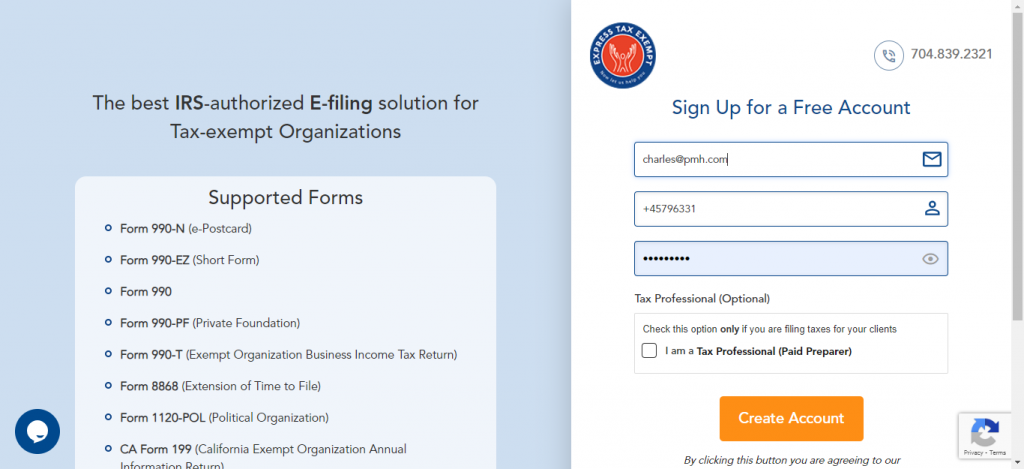

1. Create a new ExpressTaxExempt account or log in to your existing account.

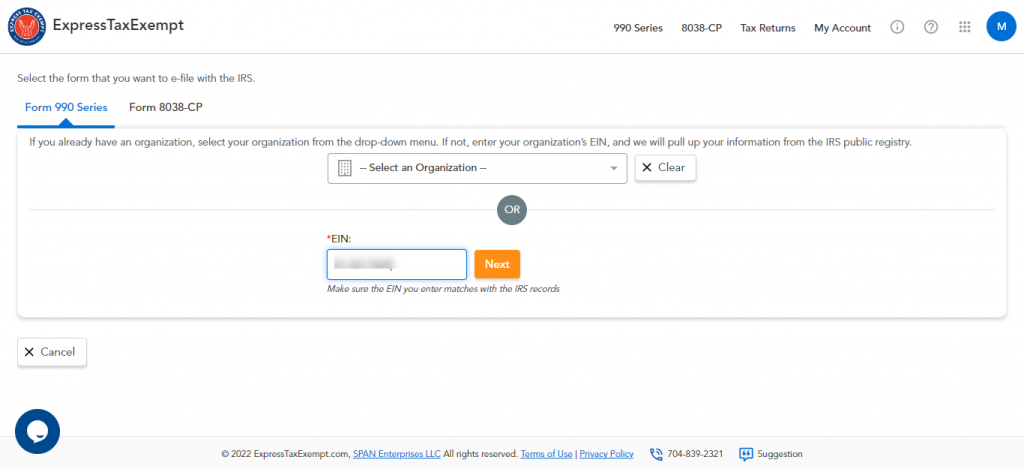

2. Search for your EIN, and our system will automatically import your organization’s basic details from the IRS database. If the details are not found in the IRS database, click ‘Continue’ and enter this information on the next page.

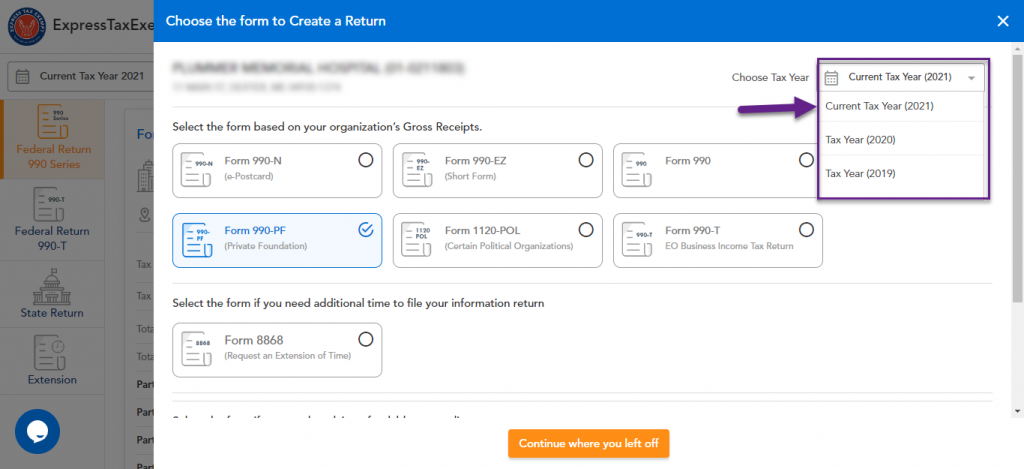

3. On the homepage, click “Start New Return” and select “Form 990-PF” in the list of forms. You can choose to file Form 990-PF for the current tax year or a prior year.

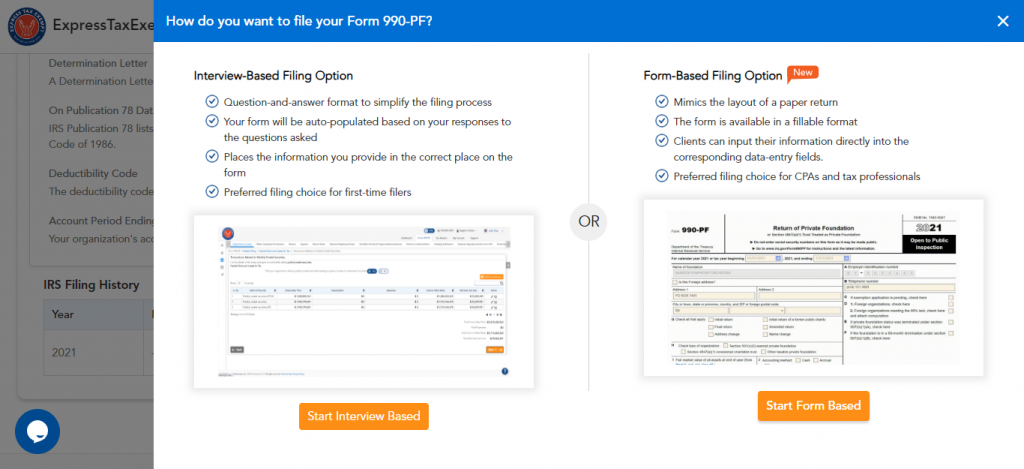

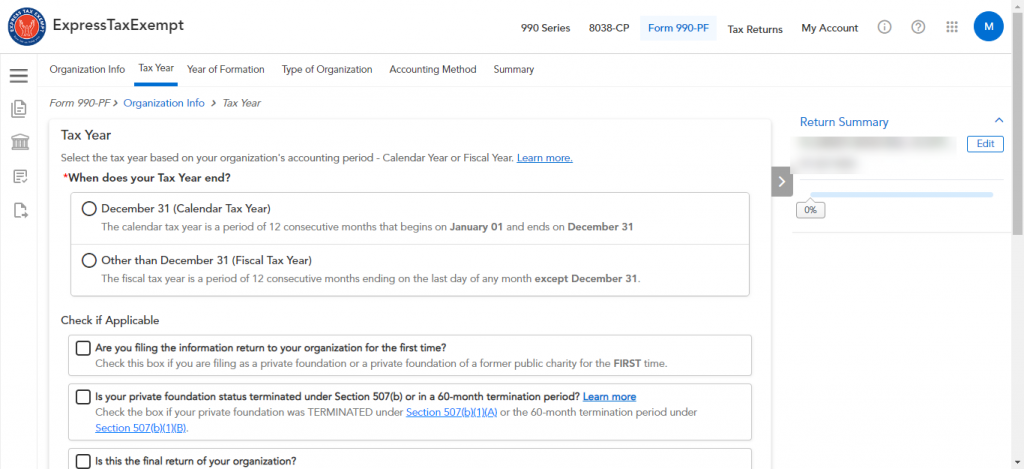

4. Then, choose the type of filing mode you prefer.

“ExpressTaxExempt provides you with two different filing methods: Form-Based Filing and Interview-style filing. If you are familiar with the paper form, we recommend Form-based Filing. We recommend that filers with less experience choose Interview-style filing for additional guidance.”

Interview-Style Filing:

- The Interview-style filing method is designed for those that are not familiar with the 990 returns and need additional guidance during the filing process. It is a unique feature that ExpressTaxExempt offers for easier filing!

- By choosing this method, you will be provided with a series of questions regarding all the information required in IRS Form 990-PF. Based on your answers, our system will complete the form automatically.

- The questions are categorized in different tabs based on their type. You can answer the questions in each tab and click “Next”. You can also go back and edit the answers you have provided before transmitting.

- If you are filing Form 990-PF for the first time or are not very familiar with the paper form, this is the way to go.

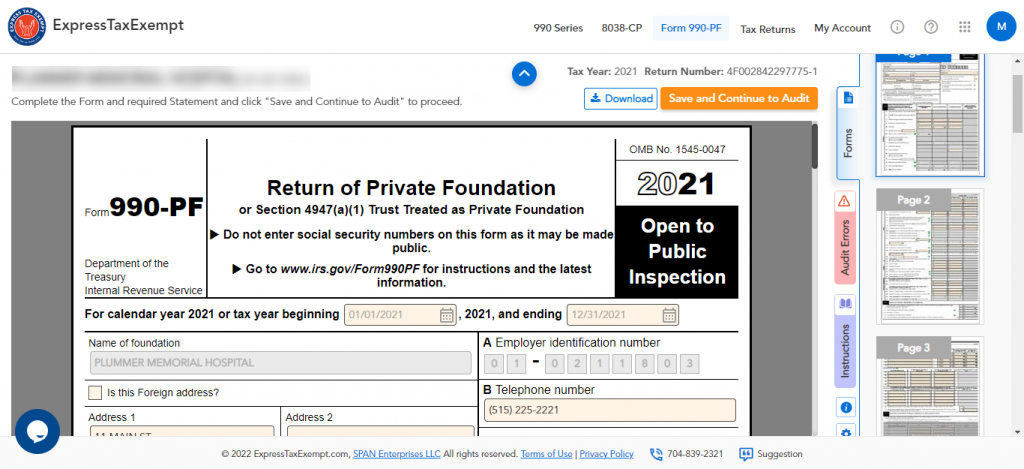

Form-Based Filing:

- With this method, the actual form will be displayed, and you can enter the details directly on each field one by one.

- Based on the details you entered earlier, our system will auto-populate certain fields regarding your organization’s basic information.

- On the right side, you can view three sections:

- Forms – You can view the summary of all the pages in your form and applicable 990 Schedules.

- Audit Errors – Our system will identify and display any errors in your form.

- Instructions – You can find the IRS instructions for your form and Schedules.

- To make filing even easier, our system provides you with an option to add Schedules instantly to the form wherever applicable.

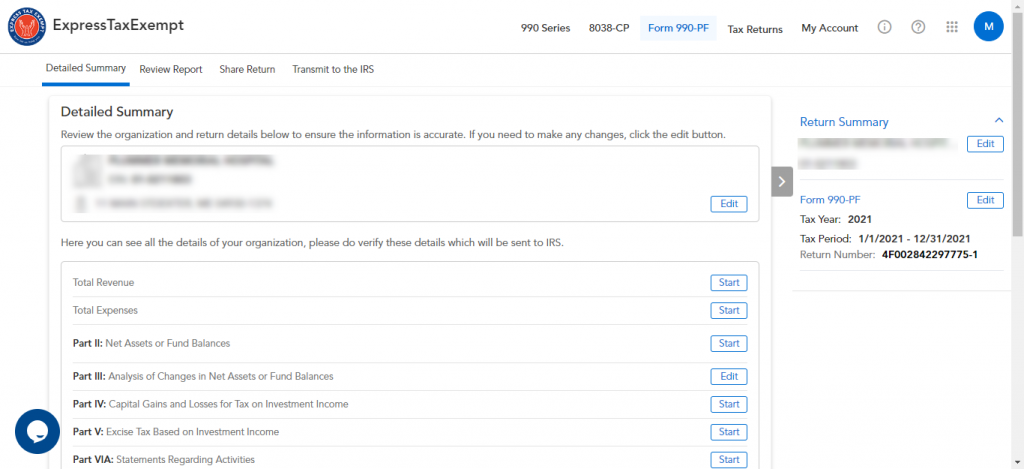

5. Once you have provided all of the required information, you can review the form summary. If there are any errors in your form, you can correct them. You can even share this return with other members of your organization for review and approval.

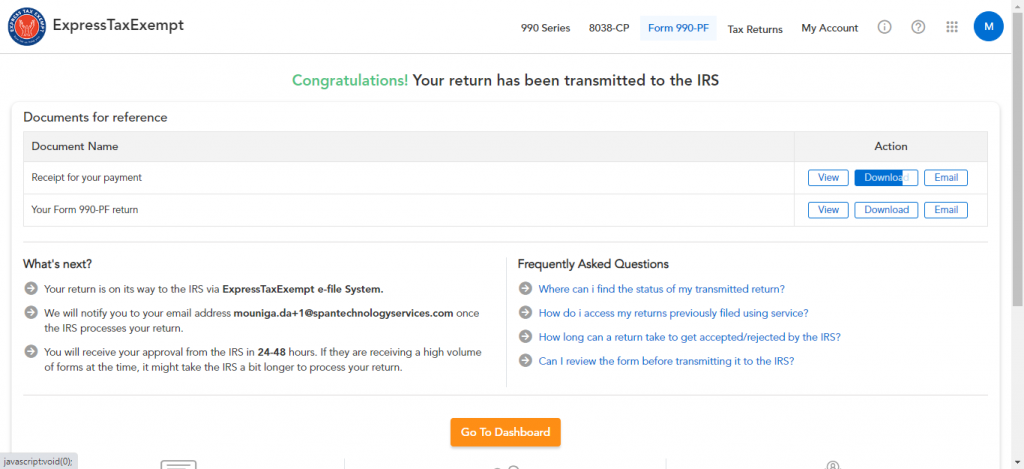

6. After reviewing the form, transmit it to the IRS.

You can choose to receive instant updates on your return’s status via email and text notifications. The status of the returns that you file will also be available in your ExpressTaxExempt account.

Want to see steps for other types of organizations or other 990 series forms and schedules? Comment below and we’ll make your request a future blog!