How-to Look up your Organization’s Information for Seamless 990 Series Return E-Filing

When you set up an account with ExpressTaxExempt you will need to know important information about your organization, including your organization’s EIN and tax year.

Did you know that you can find information about your organization using the IRS Tax Exempt Organization Search page?

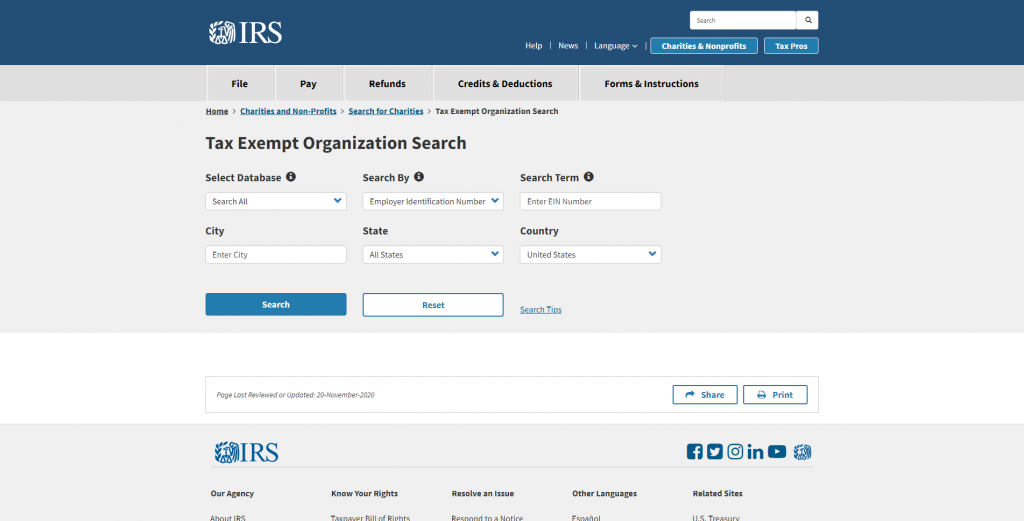

Tax Exempt Organization Search Tool

To begin, click here to be taken to the Tax Exempt Organization Search Tool.

Here, you can search for your organization by EIN. If you do not know your organization’s EIN, click the “Search By” drop-down list. This allows you to search for your organization by organization name. Please note that to find your organization by name, you must type the exact name or exact “doing business as” name as it is registered by the IRS.

If you have trouble finding your organization by name, you are able to search every tax-exempt organization within your city and state.

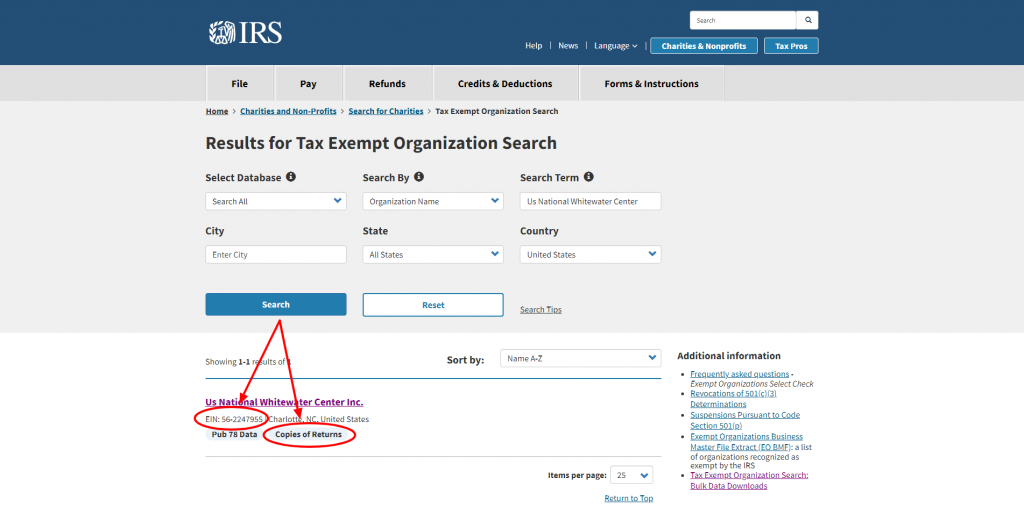

The IRS Tax Exempt Organization Search tool allows you to view your organization’s eligibility to receive tax-deductible charitable contributions, as well as review information about your organization’s tax-exempt status and filings.

Once you find your organization using the search tool, you will be able to view your organization’s EIN and see copies of your previous returns!

Depending on your organization’s status, the IRS search tool may also include your organization’s Determination Letters or Auto-Revocation List.

Past returns allow you to see which return type your organization filed in previous years. However, it is important to note that past return types are not necessarily an indication of which return your organization should file for the current tax year.

If you are new to your organization and have been tasked with the challenge of filing your organization’s annual return, past returns allow you to see the organization’s tax-exempt status and accounting method. Referencing past returns as you file can help streamline your organization’s filing process, saving you time!

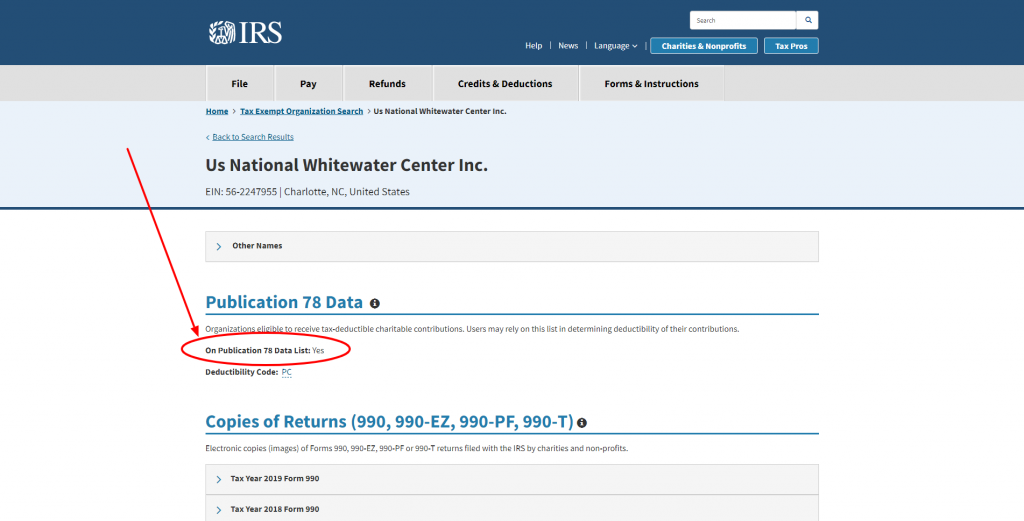

Deductibility Determination

Don’t know if your organization is eligible to receive tax-deductible charitable contributions? The IRS provides a comprehensive list to help you determine your organization’s eligibility to deduct contributions. Organizations are listed by order of their EIN in the following format: EIN | Organization Name | City | State | United States | Deductibility Code.

This information is referred to by the IRS as Publication 78 Data and can be downloaded as a notepad document from the IRS website. This information is also available using the IRS Tax Exempt Organization Search Tool under “Publication 78 Data.”

Can’t Find your EIN?

If you cannot locate your organization’s EIN and cannot find your organization by name, try calling the IRS for assistance. The phone number for the Business & Specialty Tax Line is (800) 829-4933. Normal operating hours are 7:00 a.m. – 7:00 p.m. Monday through Friday, though the best way to have your issue resolved quickly is to call earlier in the morning or later in the evening.

Click here to learn how your organization can apply for an EIN through the IRS website.

ExpressTaxExempt

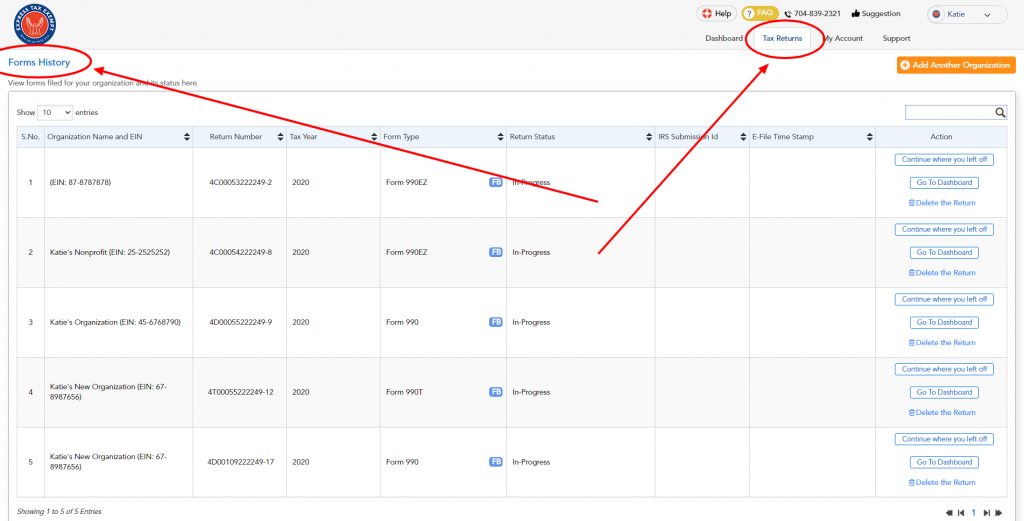

Did you know that every 990 series return that you file with ExpressTaxExempt is automatically saved within your account? To find tax returns filed with ExpressTaxExempt, click “Tax Returns.”

This will take you to the “Forms History” page, which includes each return’s status, tax year, form type, and EIN. When you choose ExpressTaxExempt as your 990 series return e-filing provider, you have easy access to past returns that you filed with us. ExpressTaxExempt is here to simplify your filing process with past returns all in one place!

Nonprofits choose ExpressTaxExempt as their go-to e-filing solution to provide an accurate, safe, and convenient e-filing experience for their IRS Form 990 returns. ExpressTaxExempt supports Form 990-EZ as well as Form 990, 990-N, 990-PF, 990-T, 1120-POL, and extension Form 8868. With all the helpful features ExpressTaxExempt has to offer, filing your return will be a breeze!

ExpressTaxExempt is a market-leading e-filing provider, for more information or to file your 990 return today, click here.