How-To File for a Short Tax Year through Form-Based 990 Series Return

A short tax year is a fiscal or calendar tax year shorter than 12 months. A short tax year may occur if your organization is not in existence for an entire tax year or if your organization changes its accounting period using IRS Form 1128.

With ExpressTaxExempt, you can e-file your 990 return if your organization has a short tax year, an exempt application is pending, or the organization’s name has changed.

Getting Started:

Here’s how to complete a form-based 990 Return for a Short Tax Year and file for your first or final tax year with ExpressTaxExempt:

1. If this is your organization’s first year in existence it may be that this is your first time filing a 990 return. Click here to sign up for an account with ExpressTaxExempt.

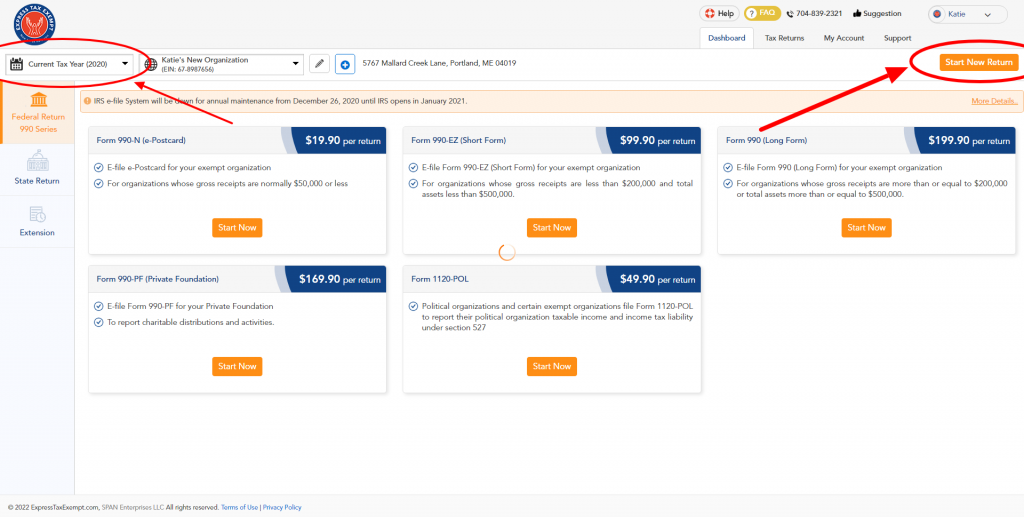

2. Once you have access to your account, select the tax year you intend to file for (located in the upper left-hand corner of your dashboard). ExpressTaxExempt supports forms for the current tax year and two prior tax years.

Either choose to start your return by clicking “Start New Return” in the upper right-hand corner of your dashboard or select the correct form for your organization and click “Start Now.”

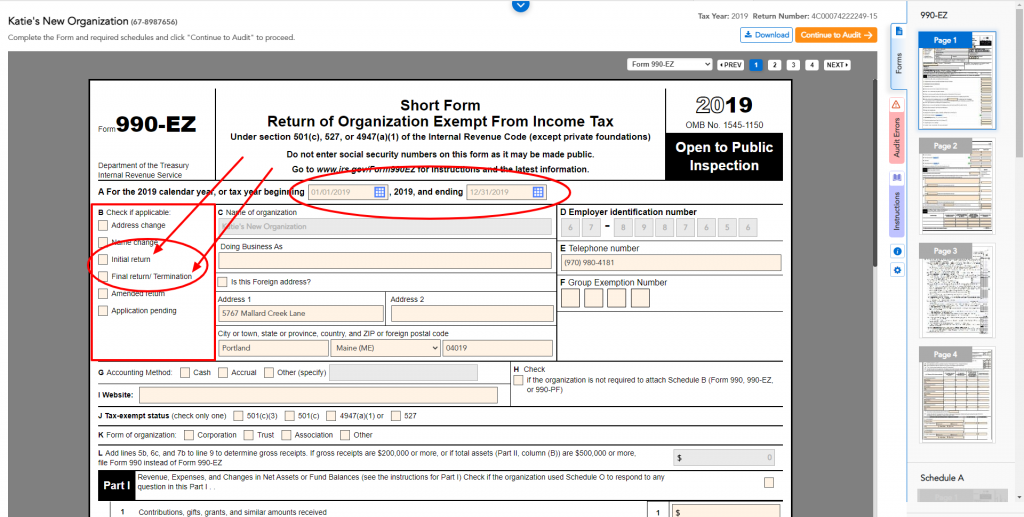

3. When you choose to file using ExpressTaxExempt’s form-based option, you can select your tax year at the top of your organization’s 990 return.

Here, select the first month and day as well as the end month and day of your tax year.

4. Located below your tax year, there is a sidebar where you can select if this is your organization’s initial return or final return.

ExpressTaxExempt

If this is your first time filing a 990 return for your organization you’ve come to the right place! Your nonprofit organization can prepare a 990 return using ExpressTaxExempt’s form-based or interview-style filing process.

ExpressTaxExempt is a market-leading e-filing provider, for more information or to file your 990 return today, click here.