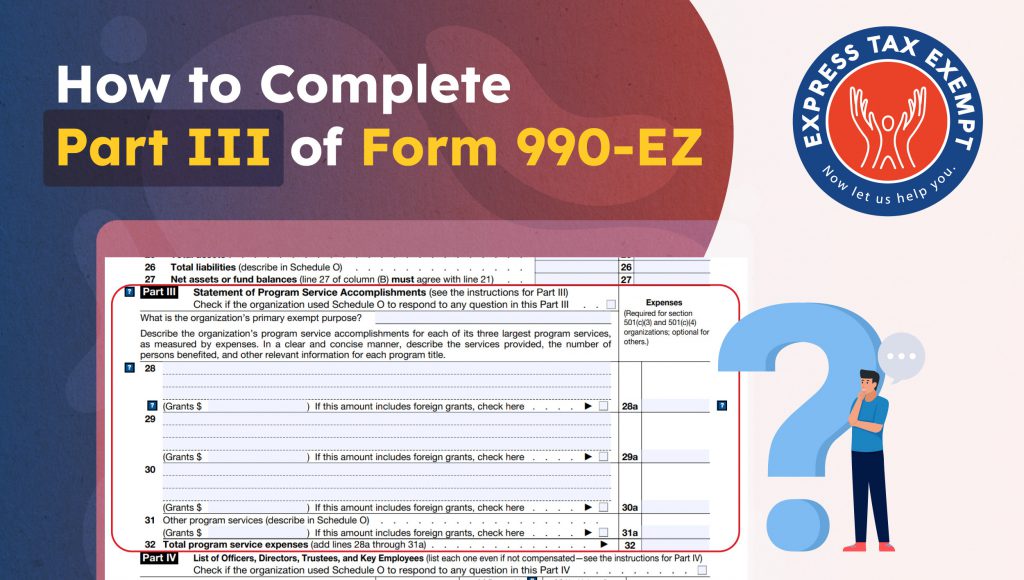

How to Complete Part III of Form 990-EZ

Nonprofit and tax-exempt organizations are probably well aware that filing 990 returns with the IRS isn’t always a walk in the park. That’s why ExpressTaxExempt is here to make your Form 990-EZ filing process and simple and efficient as possible!

Form 990-EZ can be filed by organizations with gross receipts of less than $200,000 and total assets of less than $500,000 at the end of their tax year. In our two previous blogs, we discussed completing Part I and Part II of Form 990-EZ. Next in line is completing part III of Form 990-EZ!

Part III of Form 990-EZ is the Statement of Program Service Accomplishments. This section allows organizations to describe their mission and the activities they participate in to uphold this mission. Thus, it’s important organizations provide detailed and accurate information in this section to justify their tax-exempt status.

Here’s an overview of Form 990-EZ Part III:

Program Service Accomplishments

To begin part III of the IRS Form 990-EZ, you will need to enter your organization’s primary exempt purpose. Some examples of exempt purposes set forth in section 501(c)(3) include charitable, religious, educational, literary, or scientific organizations.

After you’ve noted your organization’s primary exempt purpose, you will need to describe your organization’s program service accomplishments for each of your three largest program services. The IRS defines a program service as a “major (usually ongoing) objective of an organization, such as adoptions, recreation for the elderly, rehabilitation, or publication of journals or newsletters.”The services you list will be measured by the total expenses incurred.

Once you’ve chosen these three programs, you should briefly describe them and the accomplishments achieved through the program during the year. You should be as clear and concise as possible in your descriptions. In describing your program service accomplishments, you should use measurements such as clients served, days of care, the number of sessions or events held, or publications issued. You should also include the following information in your descriptions:

- Describe the activity’s objective, for both this time period and the longer-term goals

- Give reasonable estimates for any statistical information if exact figures aren’t readily available

Calculating Expenses

The next section of part III is related to your organization’s expenses and grants. For each program service that you previously reported on lines 28 through 31, section 501(c)(3) and 501(c)(4) you must enter, in the Expenses column, the total expenses included on line 17 for that program service. Organizations must also enter, in the Grants space for each program service, the total grants and similar amounts reported on line 10 for that specific program service.

Schedule O

Schedule O is used to provide the IRS with more specific and in-depth explanations to questions asked on Form 990-EZ. Organizations should use Schedule O to describe their other program services in detail. The information you provided earlier about your organization’s three largest services does not need to be reported in Schedule O. Information organizations should disclose in Schedule O include the amount of any donated services, or any donated use of materials, equipment, or facilities it received or utilized for a specific program service.

E-file your Form 990-EZ with ExpressTaxExempt

ExpressTaxExempt is here to ensure our client’s e-filing of Form 990-EZ is safe, secure, and accurate. When filing, clients will receive access to internal audit checks, instant notifications on their return status, and dedicated live customer support.