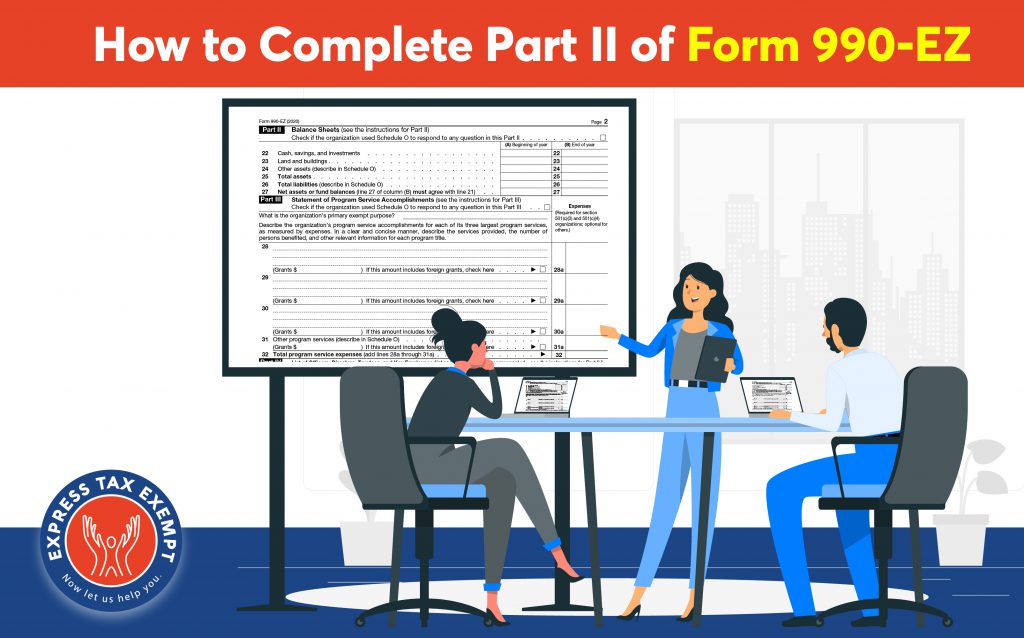

How to Complete Part II of Form 990-EZ

As your organization gets ready for the holidays, it may also be time to start thinking about your IRS filing requirements. We know they aren’t fun but it is an important part of running a nonprofit and keeping your organization tax-exempt.

There are various 990 Forms so figuring out which one your organization needs to file should be your first step. If an organization has gross receipts less than $200,000 and total assets at the end of the year less than $500,000, it can file Form 990-EZ, instead of Form 990.

In our previous blog, we outlined Form 990-EZ Part I and provided tips for completing that section. Part II of Form 990-EZ is a balance sheet that is used to provide a statement of financial position by calculating your organization’s net assets or fund balances. The balance sheet roughly shows how much money or assets your organization had at the start of the year, liabilities that you may owe, and the amount of money you have at the end of the year.

In order to make your 990-EZ filing as simple as possible, here’s a breakdown of Form 990-EZ Part II and everything you need to know to complete it!

990-EZ Part II

For starters, if your organization is filing Form 990-EZ, you are required to complete the balance sheet in part II.

Every organization that files Form 990-EZ must complete columns (A) and (B) of Part II of the return and can’t submit a substitute balance sheet. If there is no amount to report in column (A), Beginning of the year, enter a zero (“-0-“) in that column. Failure to complete Part II can result in penalties for filing an incomplete return. We will discuss these penalties in more depth later on in the blog.

To complete part II, you’ll want to have your budget handy and all your financial information prepared.

How are Net Assets Calculated?

Net assets are everything your organization owns. You will use the balance sheet to report all of your organization’s assets during the year. In order to calculate your organization’s net assets, you will need to add the value of all of your assets and subtract your liabilities from that total. It is calculated as ((Total Fixed Assets + Total Current Assets) – (Total Current Liabilities + Total Long Term Liabilities)). This will all be done as you complete the part II balance sheet on Form 990-EZ.

What Information Do I Need to Include in Form 990-EZ Part II?

Report your organization’s cash, savings, and investments

For this section, you should include all interest and non-interest bearing accounts (petty cash funds, checking accounts, savings accounts, money market funds, commercial paper, certificates of deposit, U.S. Treasury bills, and other government obligations) that your organization holds.

Report any land or buildings your organization holds

To complete this section you will need to enter the book value (cost or other basis less accumulated depreciation) of all land and buildings owned by your organization and not held for investment.

Report any other assets your organization holds

Some examples of other assets include accounts receivable, inventories, prepaid expenses, and the organization’s share of assets in any joint ventures, LLCs, and other entities treated as a partnership for federal tax purposes.

Report your organization’s total assets

You will need to enter your organization’s total assets for the year. If the end-of-year total assets entered in column (B) are $500,000 or more, Form 990 must be filed instead of Form 990-EZ.

Report your organization’s total liabilities

Liabilities include items such as accounts payable, grants payable, mortgages or other loans payable, and deferred revenue (revenue received but not yet earned).

Report your organization’s net assets or fund balances

Lastly, to complete part II, you will need to report your organization’s net assets or fund balances for the year.

Schedule O

Form 990-EZ Schedule O is used by nonprofits & tax-exempt organizations to report information that is required for specific questions on Form 990-EZ. Filers should use Schedule O to provide explanations and further descriptions to various questions mentioned in the Form.

As mentioned above, Schedule O will be used in part II. For the balance sheet, Schedule O will be used to describe the other assets that were reported on Line 24 of Form 990-EZ. Schedule O will also be used for line 26 to describe the total liabilities of your organization.

Penalties

It is important that you complete every part of Form 990-EZ and file your return on time so that you don’t incur any penalties from the IRS. If you file an incomplete or late return, your organization may be subject to the following penalties as outlined by the IRS:

Under section 6652(c)(1)(A), a penalty of $20 a day, not to exceed the lesser of $10,500 or 5% of the gross receipts of the organization for the year, can be charged when a return is filed late. Organizations with annual gross receipts exceeding $1,084,000 are subject to a penalty of $105 for each day failure continues (with a maximum penalty for any one return of $54,000). The penalty applies on each day after the due date that the return isn’t filed.

Penalties against responsible persons – If the organization doesn’t file a complete return or doesn’t furnish correct information, the IRS will send the organization a letter that includes a fixed time to fulfill these requirements. After that period ends, the person failing to comply will be charged a penalty of $10 a day with a maximum penalty of $5,000.

If your organization needs more time to submit their return, they can file Form 8868 to receive a 6-month deadline extension. You must apply for this extension on or before your Form 990-EZ deadline.

E-file your Form 990-EZ with ExpressTaxExempt

ExpressTaxExempt is a market-leading e-filing service used by thousands of non-profit organizations to file their tax returns. If your organization receives tax-exempt status from the IRS, ExpressTaxExempt is here to help your organization remain tax compliant. We know this is a huge achievement and we want to help your organization continue to succeed! That is why we make e-filing nonprofit form 990 returns such as 990-EZ easy, accurate, and secure. Meeting your annual filing requirements with ExpressTaxExempt is simple!