Completing the Balance Sheet and Reconciliation of Net Assets Parts X and XI on Form 990

Completing the balance sheet on your 990 long form can be confusing. We have broken down the process for completing the Balance Sheet and Reconciliation of Net Assets Parts X and XI on your 990 long form.

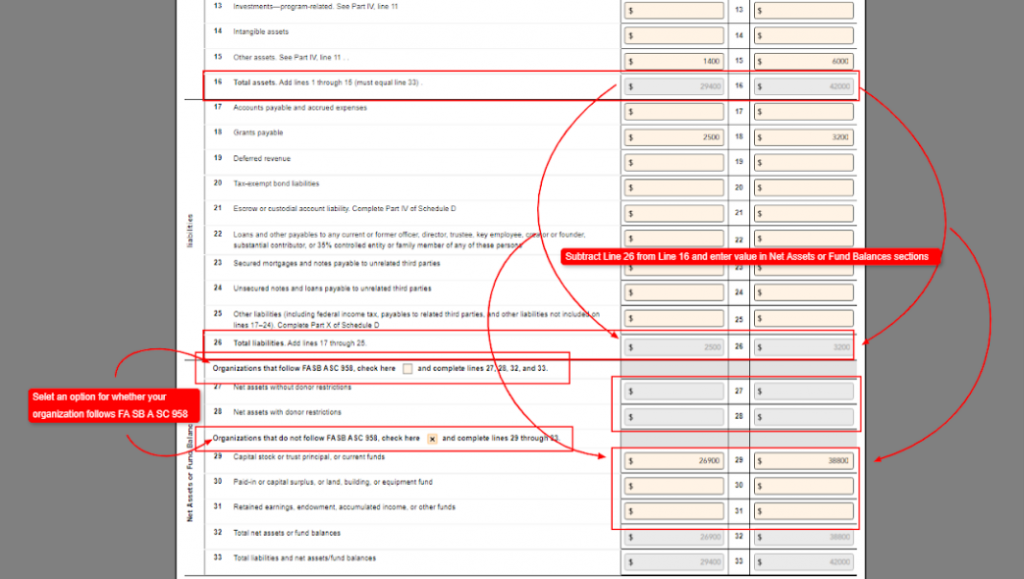

You will begin by adding all of your organization’s Assets in the necessary categories for both the beginning and end of the year. Your total from all categories in lines 1-15 in the assets section, will be calculated on Line 16 of Part X.

Getting Started with Part X: Balance Sheet

Step 1: Entering Assets

Step 2: Entering Liabilities

Once you have added all of your organization’s assets, you will proceed to the liabilities section.

Just as you did with your assets, you will add all of your organization’s Liabilities in the necessary categories for both the beginning and end of year. Your total from all categories in lines 17-25 in the liabilities section, will be calculated on Line 26 of Part X.

Step 3: Check that Lines 16 and 33 have Matching Amounts

Once you have completed the Assets and Liabilities section, you will select whether your organization follows FASB ASC 958 or does not follow FA SB A SC 958.

If your organization follows FASB ASC 958, you will check the box and complete lines 27 and 28.

If your organization does not follow FASB A SC 958, you will check the box and complete lines 29-31.

In either lines 27-28 or lines 29-31, you will input the difference between your assets and liabilities for both the beginning and end of year.

Line 32 will generate as the difference between lines 26 and 16

Line 33 will be the sum of the amounts on lines 26 and 32 to show total liabilities and net assets. The amount on line 33 must equal the amount on line 16.

Part XI: Reconciliation of Net Assets

In Part XI, lines 1-4 will auto-generate based on the information you have provided through other areas of the return. Line 10 of Part XI, must match the value on Line 32 column (b) of Part X.

Step 4: Enter Revenue and Expenses

You can add revenue or expense in lines 5-8 or by using the green (+) sign on line 9. If necessary, a negative value can be entered in these fields.

Step 5: ExpressTaxExempt will Indicate if there are Errors

If you have not completed any of these sections correctly, or your values are not meeting IRS instructions, you will receive an error message.

Are you ready to begin filing your Form 990 with ExpressTaxExempt?

Start Filing Now!