Drowning in Debt? ExpressTaxExempt is here to Help with Debt Management Strategies

Welcome back to Finance Fridays with ExpressTaxExempt! We hope you have spent some time this past week reviewing your organization’s budget using ExpressTaxExempt’s better budgeting tips! This week we will be discussing debt management and debt elimination strategies.

Join ExpressTaxExempt as we break down each component of financial literacy in a series entitled Finance Fridays in celebration of Financial Literacy Month. Check ExpressTaxExempt’s blog every Friday in April for friendly financial tips from your favorite 990 series e-filing provider.

Debt Consolidation

Debt consolidation for nonprofit organizations is very similar to traditional debt consolidation methods. The intention behind both strategies is to slowly reduce debt by decreasing interest rates until the overall monthly payment is much lower.

While other strategies will require you to list out all debts, debt consolidation combines all debts into one monthly payment. The intention here is to consolidate debt into a more manageable payment with lower interest and to reduce multiple interest payments to a single payment.

Debt Solutions

1. Debt Management Plan:

If your organization is struggling with debt, you may consider implementing a debt management plan. A debt management plan involves a nonprofit organization seeking help from a qualified credit-counseling organization.

Note that when it comes to finding a qualified credit counselor, organizations that are especially desperate to find relief from their debt may be more vulnerable to scammers. Make sure you choose to work with an organization that is certified in credit counseling.

A credit counselor may assist your organization by negotiating with creditors to significantly lower your interest rate or overall debt. A credit counselor can help create a repayment plan for your organization, typically over the span of 3-5 years. This will require an in-depth analysis of the financial standing of your organization.

2. Debt Avalanche and Debt Snowball Methods:

The Debt Avalanche and the Debt Snowball methods differ in how you approach paying off debt. The Debt Avalanche approach suggests paying off the debt by accelerating payments to the debt with the greatest interest rate first. This allows you to pay more money towards this amount first, eliminating your largest interest rate.

The Debt Snowball method differs in that it suggests paying the lowest debt amount first, despite interest rates. This allows your organization to focus more money on one debt so that you can completely pay off that debt, while slowly working away at other debt. Once you have completely paid off one debt, move your focus to the next bigger debt.

Both methods require you to list out all of your current debt. This is a great way for your organization and staff to visualize debt, providing a better image of the financial health of your organization. Additionally, both methods require that you pay the minimum required amount to each debt, but place more focus on one debt at a time.

3. Is it time to borrow?

If your organization is overwhelmed by debt to the point where operations are compromised, you may have contemplated taking out a loan. A loan can allow your organization to pay off recurring expenses and other obligations, while you direct the rest of your organization’s income towards debt.

Depending on the actions or events that led your organization into debt, a loan may help take some of the pressure off your organization as you reset. Note that a loan is only truly helpful if your organization has a plan set in place. An organization should only apply for a loan when key employees know how the funds will be used and have a plan for repayment.

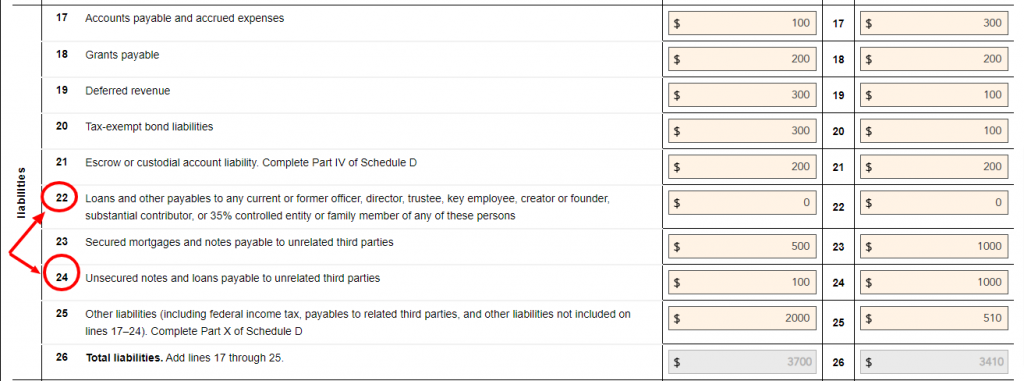

Report any loans payable in Part X of your Form 990. You can do this conveniently through ExpressTaxExempt:

4. E-file Form 990 with ExpressTaxExempt:

If your organization is deep in debt, the last thing you want is another fine from the IRS. Failure to file a Form 990 Series Return could lead to your organization owing the IRS money or losing your organization’s tax-exempt status. Don’t add to your organization’s debt! File your Form 990 Series Return today with ExpressTaxExempt.

ExpressTaxExempt

ExpressTaxExempt is here to help your nonprofit or tax-exempt organization succeed. Nonprofits choose ExpressTaxExempt as their go-to e-filing solution to provide an accurate, safe, and convenient e-filing experience for their IRS Form 990 returns. ExpressTaxExempt supports Form 990, 990-N, 990-EZ, 990-PF,990-T, 1120-POL, and extension Form 8868.