How to Complete Part I of Form 990-EZ

Organizations exempt from income tax under section 501(a) must file an annual information Nonprofit tax filing return (Form 990 or 990-EZ or Form 990-N, (e-Postcard)), depending upon the organization’s gross receipts and total assets. If an organization has gross receipts between more than $50,000 and $200,000 and total assets at the end of the year less than $500,000, it can file Form 990-EZ instead of Form 990.

Nonprofits and tax-exempt organizations must use Form 990-EZ to report to the IRS their revenue, expenses, assets, liabilities, program service accomplishments, and organizations officer details

Filing Form 990-EZ on time is essential so that your organization can remain tax-compliant and avoid any penalties from the IRS. Using an e-filing service such as ExpressTaxExempt can help simplify your Form 990-EZ filing process and ensure your returns are filed on time, every time.

ExpressTaxExempt is here to make your 990-EZ filing experience as easy, accurate, and efficient as possible. Follow these helpful instructions to complete Part I of Form 990-EZ:

Part I of Form 990-EZ

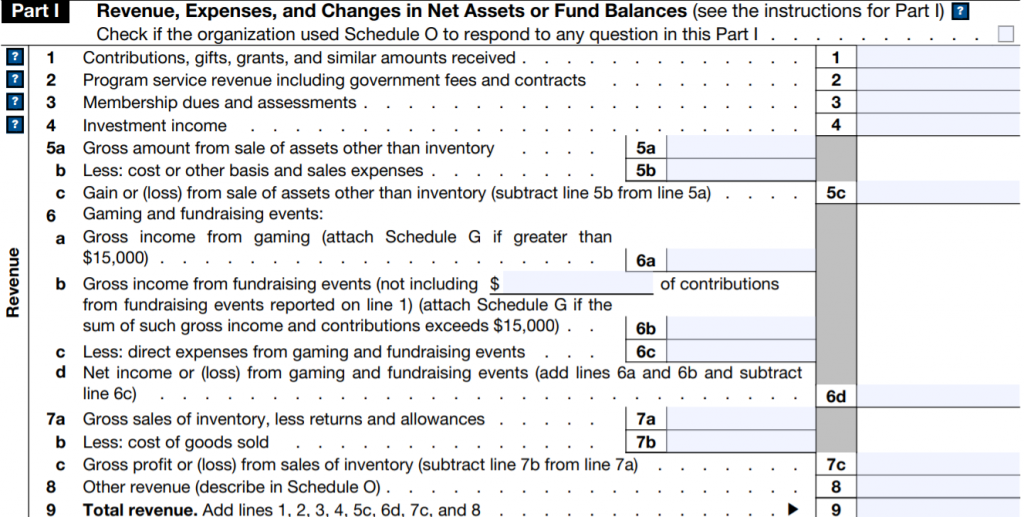

Part I of Form 990-EZ is comprised of three different sections including revenue, expenses, and net assets. Thus, Part I is labeled – Revenue, Expenses, and Changes in Net Assets or Fund Balances.

Revenue

This section of part I is all about the revenue earned by the organization for the tax year. The revenue section of part I consists of lines (1-9) and you will need to add up all the funds your organization received during the year. In doing so, you will report how much your nonprofit made in the following categories:

- Contributions, gifts, and grants

- Program service revenue and government fees and contracts

- Membership dues and assessments

- Investment income

- Sale of any assets

- Gross income from gaming, and fundraising events (The filing organization must attach Schedule G if they receive more than $15,000 gross income from gaming and fundraising events)

- Other incomes such as interest from loans to officers, directors, trustees, key employees, and other employees.

- Other revenues should be described in Schedule O, Supplemental Information.

After you’ve reported all of these funds, you will need to add lines 1 through 8 together and input the total on line 9. This amount is your organization’s revenue for the tax year.

Click here, to know more about the revenue part when filing Form 990-EZ.

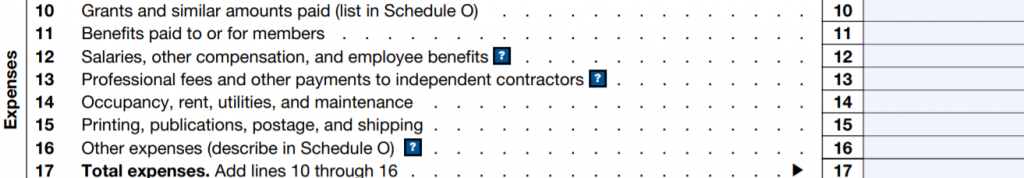

Expenses

In this section of part I, you will need to report your organization’s functional expenses. Reporting your expenses includes everything from how much it costs to rent and maintain your space to your employees’ benefits and salaries. The expenses section consists of lines (10-17) and you must report the following information:

- Grants and similar amounts paid

- List on Schedule O (Form 990 or 990-EZ) each grantee organization or individual to whom the organization made grants (or paid similar amounts) in excess of $5,000 during the organization’s tax year. For each grantee, list:

- Each class of activity;

- The grantee’s name and address (for grantee organizations, not grantee individuals);

- The amount given (aggregate amount of grants and payments to or for the benefit of the grantee during the organization’s tax year); and

- The relationship of the grantee (for grants to individuals), if the relationship is by blood, marriage, adoption, or employment (including employees’ children), control, or ownership, to any person or corporation with an interest in the organization, such as a creator, donor, director, trustee, officer, key employee, related organization, etc.

- List on Schedule O (Form 990 or 990-EZ) each grantee organization or individual to whom the organization made grants (or paid similar amounts) in excess of $5,000 during the organization’s tax year. For each grantee, list:

- Benefits paid to or for members

- Salaries, other compensation, and employee benefits

- Professional fees and other payments to independent contractors

- Occupancy, rent utilities, and maintenance

- Printing, publications, postage, and shipping

- Other expenses should be described in Schedule O, Supplemental Information.

After you’ve reported all this information, you should add lines 10 through 16 together and input the total on line 17. This amount is your business’s total expenses for the tax year.

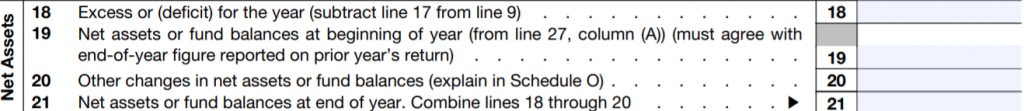

Net Assets

The third section of part I, which consists of lines (18-20), requires information about the net assets of the organization for the tax year. Net assets are generally the value of a company’s assets minus its liabilities. To complete this portion of part I, you must report the following:

- Excess or (deficit) for the year

- Net assets or fund balances at the beginning of the year

- Other changes in net assets or fund balances

- Explain in Schedule O (Form 990 or 990-EZ) any changes in net assets or fund balances between the beginning and end of the organization’s tax year that aren’t accounted for by the amount on line 18. Include items here such as:

- Adjustments of earlier years’ activity (such as losses on uncollectible pledges, refunds of contributions and program service revenue, and reversal of grant expenses);

- Unrealized gains and losses on investments carried at market value; and

- Any difference between FMV and book value of property given as an award or grant.

- Net assets or fund balances at the end of the year

After you’ve completed the revenue, expenses, and net asset sections, part I of Form 990-EZ is complete.

Click here, for more information on step-by-step instructions for Form 990-EZ .

E-file your Form 990-EZ with ExpressTaxExempt

Using an IRS-authorized e-filing provider such as ExpressTaxExempt can make your Form 990-EZ filing convenient and hassle-free.

ExpressTaxExempt provides helpful step-by-step instructions to guide filers through their entire filing process. We also provide several other resources and tools to ensure clients’ filing is easy and accurate. Some of these features include internal audit checks, multi-user access, and free attachable 990-EZ Schedules. You can also copy data from prior year returns and re-transmit rejected returns for free.

With ExpressTaxExempt your organization can file your Nonprofit Form 990 returns with ease and remain tax-compliant.