Author: Stephanie Glanville

taxexempt organizations

The Form 990 is a federal tax requirement for tax exempt organizations across the country. The IRS mandates that every tax exempt organization must file the Form 990

Read More

990 News

Organizations that are required to file between April 15, 2020 and June 15, 2020 will have additional time to file.

Read More

fileform990

This form may be paper filed or filed electronically with the IRS

Read More

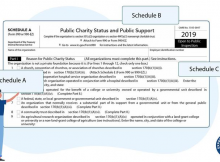

990 Schedules

This can be a bit overwhelming, so hang in there while we cover the basics of each schedule.

Read More

fileform990

The Form 990 has 12 parts, we are breaking down each of them.

Read More

990 information

Here is what you need to know to successfully file your Form 990 with the IRS.

Read More

990-EZ penalties

Failing to file this form or filing this form incorrectly can become a big issue for tax exempt organizations.

Read More

990-EZ

Here is some helpful information to get you started on your Form 990-EZ.

Read More

990-EZ

The Form 990-EZ is an IRS tax form that is designed specifically for tax exempt organizations.

Read More

990 penalties

What are the consequences of filing Form 990-PF late or failing to file at all?

Read More