How Many Form 990 Schedules are there and Which Do I Need?

So, we’ve covered the purpose of the Form 990 and the basics of filing out this IRS Tax Form, now let’s talk about schedules. There are 16 schedules associated with the Form 990, they all report different information on an in depth level.

This can be a bit overwhelming, so hang in there while we cover the basics of each schedule. This will determine which your organization needs to file and which you can forget about…for now.

For a more detailed look at each schedule, follow the link below.

https://www.expresstaxexempt.com/form-990/form-990-schedules/

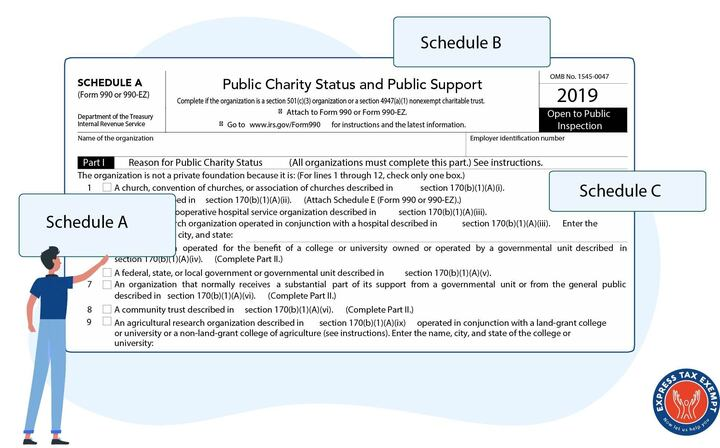

- Schedule A- Public Charity Status and Public Support

Schedule A is a general rundown of your organization. It covers the basics. Why does your organization exist? Who do you serve? It describes how your organization is classified and how much monetary support you are receiving from the public (grants, contributions, etc).

The following organization types need to complete and attach this schedule to their Form 990.

- 501(c)(3)

- 501(e)

- 501(f)

- 501(j)

- 501(k)

- 501(n)

Learn more about Form 990 Schedule A

2. Schedule B- Schedule of Contributors

Organizations that have received contributions of $5,000 or greater from a single contributor, they must file this schedule. This schedule applies to either monetary or in kind contributions.

Learn more about Form 990 Schedule B

3. Schedule C- Political Campaign and Lobbying Activities

Organizations that have any involvement with political campaigns or lobbying activities, these must be reported in Schedule C.

Learn more about Form 990 Schedule C

4. Schedule D- Supplemental Financial Statements

The reporting in Schedule D is required for organizations that have donor advised funds, endowment funds, escrow accounts, and certain art or museum collections.

Learn more about Form 990 Schedule D

5. Schedule E- Supplemental Financial Statements

This schedule is specifically for private schools.

Learn more about Form 990 Schedule E

6. Schedule F- Statement of Activities Outside the United States

Has your organization conducted any activities outside of the United States this year? Have you conducted any programs or fundraising activities in another country. If so, you will need to attach Schedule F to your Form 990.

Learn more about Form 990 Schedule F

7. Schedule G- Supplemental Information Regarding Fundraising or Gaming Activities

If you checked “yes” in Part IV of your Form 990, the Checklist of Required Schedules, you will be required to complete Schedule G.

This schedule provides additional information that pertains to your fundraising activities. You will need to include information related to any fundraisers that you have conducted and any game of chance that your organization has overseen.

Learn more about Form 990 Schedule G

8. Schedule H- Hospitals

This schedule is pretty self-explanatory. This schedule dives into the specific information related to any not for profit hospital or health care facility operations.

Learn more about Form 990 Schedule H

9. Schedule I- Grants and Other Assistance to Organizations, Governments, and Individuals in the US

If you have received more than $5,000 in grant money during the tax year, your organization is responsible for reporting that information in this schedule.

Learn more about Form 990 Schedule I

10. Schedule J- Compensation Information

This schedule reports the compensation information for any officers, trustees, and key employees within the organization.

Learn more about Form 990 Schedule J

11. Schedule K- Supplemental Information on Tax-Exempt Bonds

The IRS wants to know about any of your outstanding liabilities, in this schedule you will report liabilities related to Tax-Exempt Bonds.

Learn more about Form 990 Schedule K

12. Schedule L- Transactions With Interested Persons

The IRS requires you to report transactions that were beneficial to your organization. These benefits are considered excessive if they do not fall within what the IRS deems “reasonable compensation”.

Learn more about Form 990 Schedule L

13. Schedule M- Noncash Contributions

Organizations reporting more than $25,000 in noncash contributions should complete this schedule. The IRS wants to know more about the in kind donations that you received throughout the tax year to ensure that you are a good steward of these donations.

Learn more about Form 990 Schedule M

14. Schedule N- Liquidation, Termination, Dissolution, or Significant

If your organization is dissolving or disposing of 25% or more of their net assets by sale or exchange, you will need to attach this schedule.

Learn more about Form 990 Schedule N

15. Schedule O- Supplemental Information

Organizations use this Schedule to provide the explanation required for responses to specific questions on Form 990 or 990-EZ.

Learn more about Form 990 Schedule O

16. Schedule R- Related Organizations and Unrelated Partnerships

The IRS wants to know more about the organizations that you partner with regularly. Complete this schedule if you answered “yes” on the following lines on your Form 990.

- Part IV, line 33

- Part IV, line 34

- Part IV, line 35b

- Part IV, line 36

Learn more about Form 990 Schedule R

Choose ExpressTaxExempt to file your Form 990 with the Required Schedules

These are all of the Schedules that apply to the Form 990, you may not be required to file them all, but now you have taken a quick look at each one. When you file your Form 990 with ExpressTaxExempt, our software will help you gather the information needed to populate each necessary schedule. If you didn’t already need another reason to e-file, not having to worry about your schedules is a great one!