Instructions to file your Form 990-PF – A Complete Guide

Filing IRS tax Form 990-PF for your private foundation can be tricky. The team at ExpressTaxExempt is here to help you!

Check out the instructions below to learn more about the 990-PF filing process and requirements.

What is Form 990 PF?

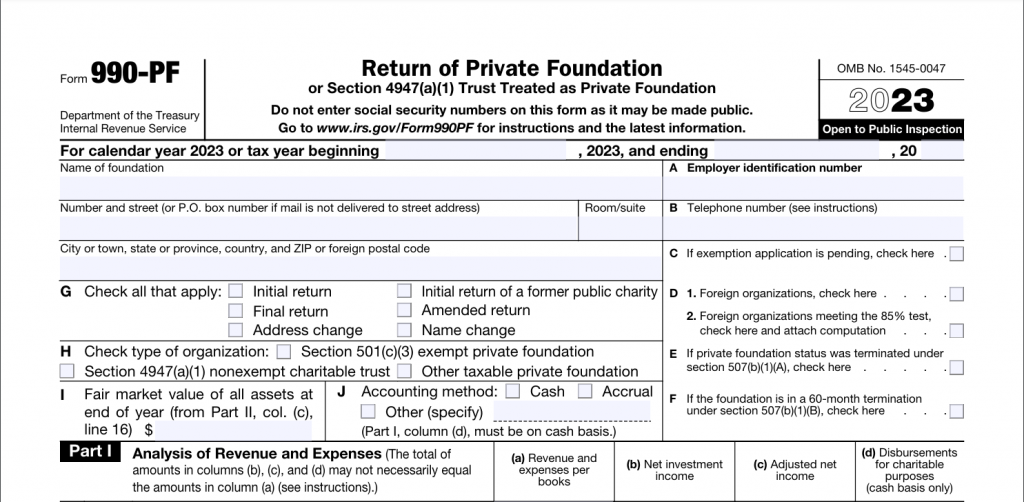

Form 990-PF is the IRS tax form that private foundations must file annually. Form 990-PF is designed specifically for private foundations to report the tax based on investment income, and the charitable distributions and activities.

What is the Deadline To File Form 990-PF with the IRS?

The general rule for filing Form 990-PF is that the organization must file its form with the IRS no later than 5 months and 15 days following the close of their tax year.

For organizations that operate on a calendar year, this deadline falls on May 15.

What Information Is Required on Form 990-PF?

When filing Form 990-PF you will need an assortment of information about your organization including basic business information including your EIN, foundation name, and mailing address. You will also need more complex financial information as well, such as your organization’s gross receipts, income interest, and financial disbursement details.

Instructions on how to complete each part of Form 990-PF

Form 990-PF consists of 13 pages and it is split into 18 parts. Each part requires certain information which is explained in the table below.

| Parts | Form 990-PF Parts Instructions |

| Part I – Analysis of Revenue and Expense | Enter the organization’s revenue and expenses from line 1 to 27 to calculate the total investment income and adjusted net income. |

| Part II- Balance Sheet | Enter the values of organizations’ assets, and liabilities from lines 1 to 23 to calculate the Net Assets or fund balances. |

| Part III- Analysis of Changes In Net Assets or Fund Balances | Enter the information about total assets at the beginning of the year and total expenses and disbursements to calculate the Total net assets or fund balances at the end of the year. |

| Part IV- Capital Gains and Losses for Tax on Investment Income | Enter the details of the list of properties sold, date of acquisition, and how it was acquired, gross sale price, Cost or other basis plus expense of sale, fair market value to calculate the amount of net capital gain. |

| Part V- Qualification under Section 4940(e) for Reduced Tax on Net Investment Income | Enter the qualifying distributions, Net value of noncharitable-use assets used by domestic private foundations (exempt and taxable) to calculate whether they qualify for the reduced 1% tax under section 4940(e) on net investment income rather than the 2% tax on net investment income under section 4940(a). |

| Part VI – Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948) | Domestic exempt and taxable private foundations, Foreign organizations must enter the tax details, any penalties for underpayment of estimated tax to calculate the tax due, overpayment |

| Part VII-A Statements Regarding Activities | Enter the activity of organizations such as political purposes, reimbursement paid by the foundation during the year for political expenditure, unrelated business incomes, website address, books are in the care of details, substantial contributors |

| Part VII-B Statements Regarding Activities for Which Form 4720 May Be Required | Enter the activities of sale or exchange, or leasing of property, Borrow money from, lend money, furnishing goods, Pay compensation to, or pay or reimburse the expenses to a disqualified persons, Taxes on failure to distribute income provided any amounts for religious purposes |

| Part VIII – Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, and Contractors | Enter the Organizations officers, directors, manager details of Title, and average hours per week devoted to position, compensation paid, contributions to employee benefits, expense accounts. Enter the same information for Compensation of five highest-paid employees (employee paid more than $50,000) |

| Part IX-A Summary of Direct Charitable Activities | List the four largest programs and the expenses during the tax year. Provide the relevant statistical information such as the number of organizations and other beneficiaries served, conferences convened, research papers produced, etc. |

| Part IX-B Summary of Program-Related Investments | Enter all program-related investments made for the tax year. Don’t report any investments made in a prior year even if they were still held by the foundation for the tax year. |

| Part X – Minimum Investment Return | All domestic foundations must complete this part. Enter the fair market value of assets not used (or held for use) directly in carrying out charitable, etc., Average monthly fair market value of securities, Average of monthly cash balances, the fair market value of other assets. The values are used to calculate the minimum investment return. |

| Part XI- Distributable Amount | Enter the taxes on investment income, income tax for 2019, the distributable amount before adjustments, deduction from the distributable amount |

| Part XII Qualifying Distributions | “Qualifying distributions” meant by the amounts spent or set aside for religious, educational, or similar charitable purposes. Enter the amounts spent on the expenses, contributions, gifts, amounts paid to buy assets for used directly in carrying out charitable purposes. Click here to know more about the Form 990-PF instructions about Qualifying Distributions. |

| Part XIII Undistributed Income | Eventually, a private foundation that is not a private operating foundation is required to distribute annually – through grants and grant-related expenses – at least 5% of the total fair market value of its noncharitable-use assets for the tax year. Enter the undistributed income details of the year prior to 2018, 2019. |

| Part XIV Private Operating Foundations | “private operating foundation” means any private foundation that spends at least 85% of the smaller of its adjusted net income or its minimum investment return directly for the active conduct of the exempt purpose or functions for which the foundation is organized and operated (the income test) and that also meets one of the three tests below. 1. Assets test 2. Endowment test 3. Support test Private operating Foundations should use this part to enter the test information. Refer to the 990-PF instructions to know more about all the tests. |

| Part XV- Supplementary Information | Private Foundations should complete this part of the foundation had assets of $5,000 or more at any time during the year. Enter the Information Regarding Foundation Managers, Information Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs. For during the year, and approved for future payment. Check with the supplementary information instructions to know the foundations status of Recipient to enter on the |

| Part XVI-A Analysis of Income-Producing Activities | List each revenue-producing program service activity of the organization. The services can also include the organization’s unrelated trade or business activities, program-related investments (such as interest earned on scholarship loans), Interest on savings and temporary cash investments, Dividends, and interest from securities. |

| Part XVI-B Relationship of Activities to the Accomplishment of Exempt Purposes | Explain in brief about how each activity for which income is Related or exempt functions. |

| Part XVII- Information Regarding Transactions to and Transactions and Relationships with Non-Charitable Tax-Exempt Organizations | This part is used to report direct and indirect transfers to and direct and indirect transactions with and relationships with any other noncharitable exempt organization. A noncharitable exempt organization is “related to or affiliated with” the reporting organization if either: The two organizations share some element of common control, or historic and continuing relationship exists between the two organizations. A noncharitable exempt organization is unrelated to the reporting organization if: The two organizations share no element of common control, and historic and continuing relationship doesn’t exist between the two organizations. Check with the instructions to know about the element of control. |

To learn more about 990-PF Filing instructions, please visit https://www.expresstaxexempt.com/form-990-pf/form-990-pf-instructions/

You can also learn more in this video!

What Private Foundations Need to Know About Form 990-PF?

Instructions of Form 990-PF Schedule B?

Schedule B is required for organizations with contributions, both monetary and in-kind totaling $5,000 or more. This Form can be filed electronically and attached to the 990-PF when you file with ExpressTaxExempt.

E-file Form 990-PF With ExpressTaxExempt

Filing with ExpressTaxExempt is both simple and efficient.

Our software is designed to simplify your filing experience with an interview-style process. Creating an account is free and follow our step-by-step instructions to complete the form easily.

As an IRS-authorized E-file Provider, ExpressTaxExempt is a trusted source to help you file your Form 990-PF with confidence.